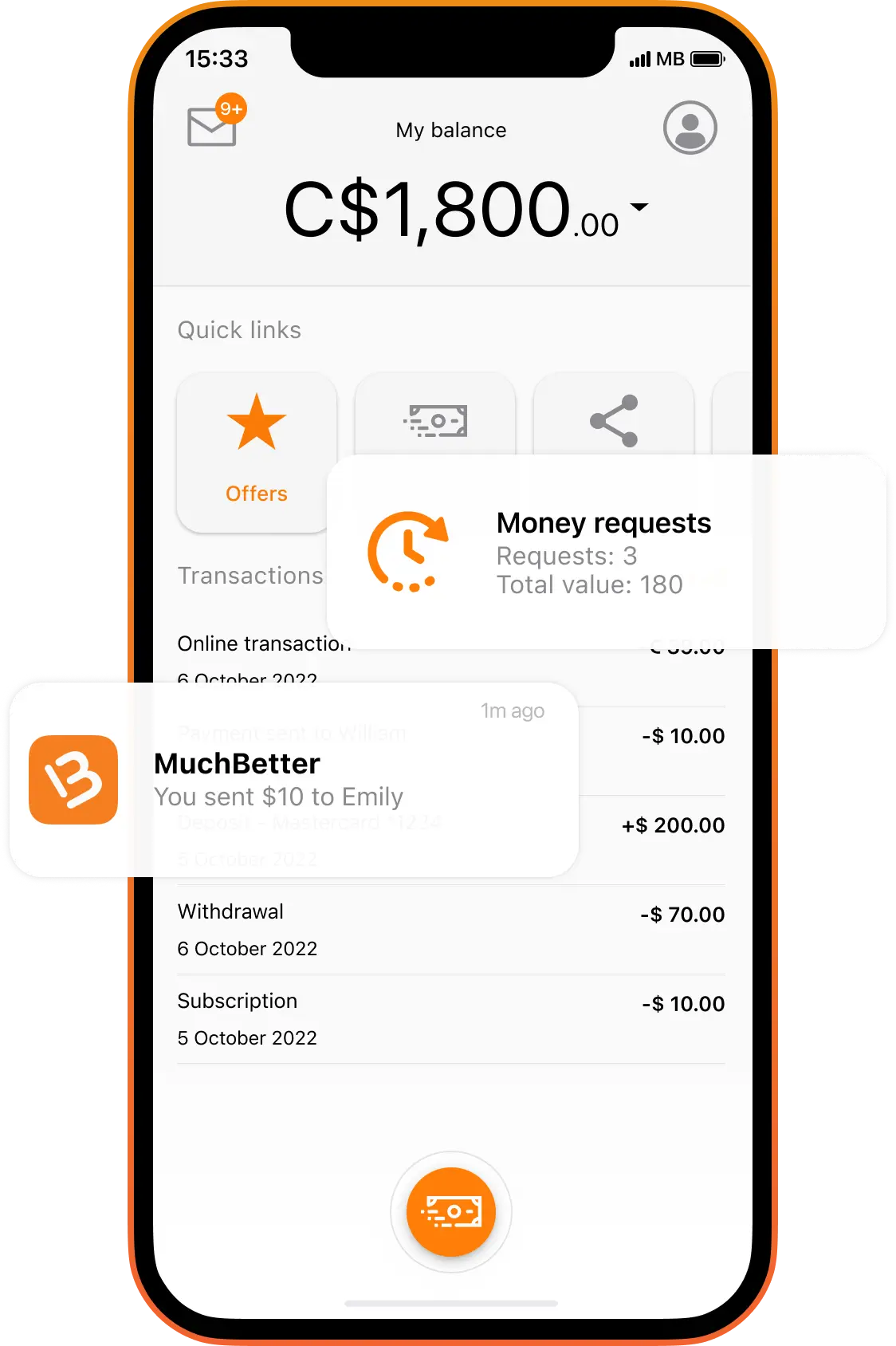

Use the MuchBetter wallet to top up, withdraw, send and store your money.

UK and EEA customers can also pair their wallet with the MuchBetter prepaid Mastercard® or one of our cool contactless devices to spend on the go.

Designed to power e-commerce performance, MuchBetter Gateway’s sophisticated single API integration gives businesses access to a wide range of localised payment methods.

Download MuchBetter Wallet on Google Play or the App Store to get started today.

The digital wallet ready for everyday spending. Top up, withdraw, send and store your money with ease.

© 2023 MuchBetter | All rights reserved

MIR Limited UK Ltd: Registered office, Signature By Regus, Berkeley Square House, 2nd Floor, London, England, W1J 6BD. Regulation: Licensed and regulated as an electronic-money institution (EMI) by the UK Financial Conduct Authority (FCA) License No.: 900704.

QuickPay Limited: Registered office, The Black Church, St Mary’s Place, Dublin 7, Dublin, Ireland, D07P 4AX, registered under number 641373. Licensed and regulated as an Electronic Money Distributor of Sureswipe E.M.I. PLC trading as Revsto, which is licensed by the Central Bank of Cyprus to operate as a licensed Electronic Money Institution, license number 115.1.3.26.

Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

The MuchBetter card is issued by Paynovate SA pursuant to licence from Mastercard. Paynovate SA is an e-money issuer regulated by the National Bank of Belgium. Paynovate SA is registered with the Banque-Carrefour des Enterprises under number BE0506 763 929.

©MuchBetter and the images on muchbetter.com are protected by copyright 2023. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.