E-portemonnee

Veilig geld uitgeven, versturen en bewaren. De digitale portemonnee, klaar voor dagelijkse uitgaven.

Gebruik de MuchBetter Wallet om eenvoudig geld op te waarderen, op te nemen, te verzenden en op te slaan.

Ringen

Of u nu onderweg naar uw werk een kopje koffie haalt of naar de trein rent, zorg dat u uw portemonnee in uw zak houdt en uw telefoon uit het zicht.

Het enige wat je nodig hebt is de RING!

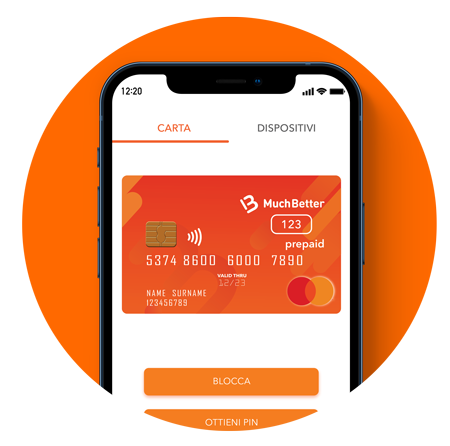

Kaarten

Klanten in het Verenigd Koninkrijk, de EER en Canada kunnen de portemonnee koppelen aan de MuchBetter prepaid Mastercard® Tap and Pay overal waar u het contactloos-symbool of het Mastercard®-logo ziet, en zo de aandacht trekken van de kassa.

-

-

-